|

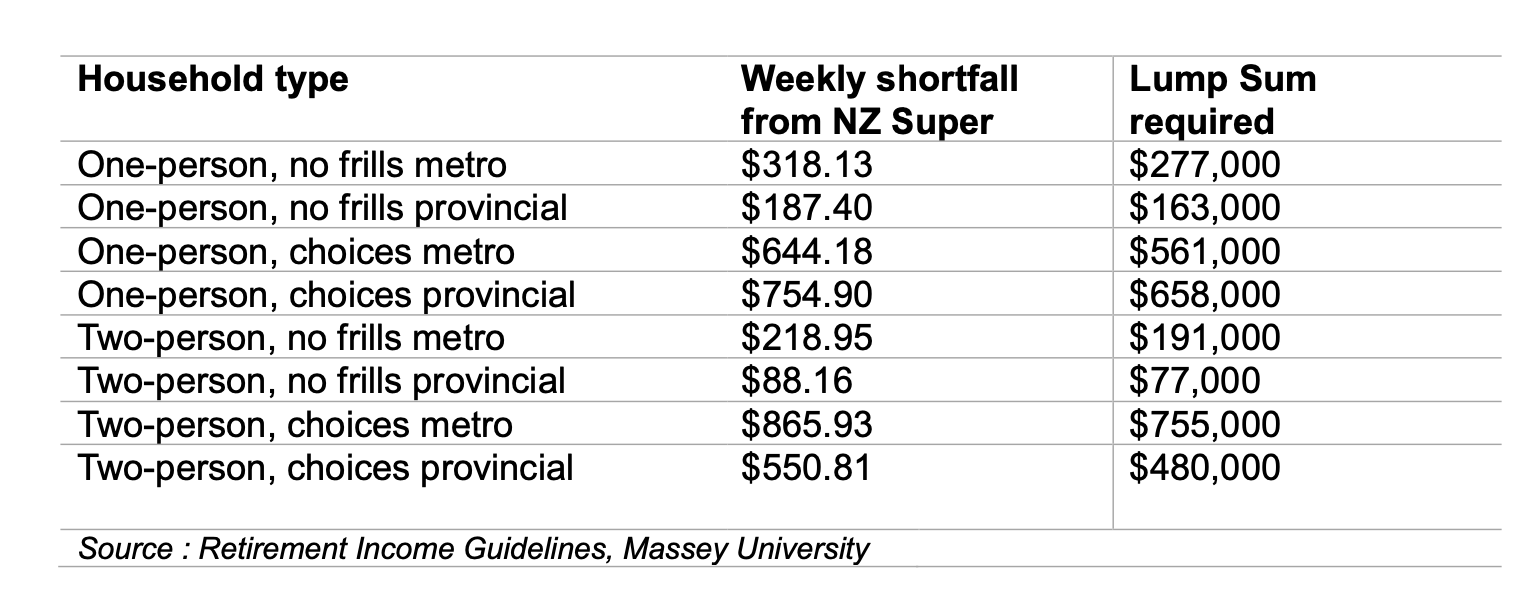

Financial Planning for Retirement Those clever planning types (you know the ones, they’re good at spreadsheets) set the example by getting ahead of the game. But for those amongst us who are more of the creative, ‘fly by the seat of your pants type’, how do we arrange finances so we don’t arrive at 65, 75, 85 then wonder how to afford a few tea bags and a reasonable haircut? Suzi Brown explains Each decade or season of life brings an opportunity to get your financial ducks in an organised row, so you can continue enjoying the kind of lifestyle you’ve enjoyed during working years, in your retirement.  To begin the process, it would be helpful to have a dollar figure goal in mind. But considering we’re not given a definite number of years at birth, how on earth can do we work out how much we’ll need? Stats NZ Tatauranga Aotearoa’s latest report shows life expectancy at birth has continued to increase. They now project males to live to 86.1 years and females to 89 years by 2050. In researching this article, I stumbled upon a somewhat grim-reeperish, yet necessary tool which has been created called the ‘How long will I live calculator’ on the stats.govt website. Basically, you enter the year you were born, your age and sex and kazam! There’s your answer, divided helpfully into three categories assuming low, medium and high death rates. You’ll also need to decide whether you’d like to live a no frills or extravagant retirement lifestyle or sit somewhere in the middle with enough popped aside for the odd splurge if the opportunity arises. It’s really an essential first step for smart retirement planning – overestimate your longevity on the one hand and you could leave retirement too late or live too frugally, but underestimate and you could be low on funds. The table overleaf, put together by Massey University, gives you an estimate of the type of figure you may need to work toward. This amount depends on the number of people in your household, whether you’ll be aiming for a no-frills or ‘choices’ type of retirement and your location. Once you’ve figured out your sobering estimate of years left on earth and broken down how much you might need, it’s time to write some lists. Start with jotting down the things that are important for you to do now, and that you’d like to continue doing when you stop paid work. Then – this is the fun bit – add the things you have always wanted to do during retirement. Don’t be afraid to be extravagant at first! That’s what a budget is for. Write down that fancy cruise you’ve always dreamed of. It might mean you have to scrimp and save, or maybe buy second hand a bit more, but keep your end goal in mind and do what you need to do to get to those big ticket items – YOLO (you only live once)!  Where do your dollars and cents actually go? It’s smart to be organised when spending, to allow for as much saving opportunity as possible. Think about: Renewing subscriptions: sift through your credit card statements carefully and check for subscriptions you don’t need or didn’t even realise you were still paying for. Planning meals and grocery shopping – regular meals out or last-minute takeaways can really impact your pocket. Plan your weekly meals and shop accordingly to save those hangry dashes at the drive through! Prioritise paying off high-interest debt – be wary of purchases that offer monthly payments with interest. Does your spending match your goals and values? – keep your core values at the forefront. Before you pull out your EFTPOS card ask yourself if the purchase you’re about to make lines up with what’s really important to you. Why not earn a few extra bucks? Around a third of Kiwis continue some form of paid work past age 65. It’s a great way to add a few more dollars to cover your daily expenses, as well as keep some social connection and continue to feel a sense of value. Think about finding an opportunity which allows more flexible hours, part time or casual work, consultancy or mentoring, and the great thing is, income from paid work will not affect your entitlement to NZ Super. Your house is an asset It’s a really good idea to think ahead about where you're planning to live once you’ve hit the golden age of retirement. If you’ve been living in your family home for some time, selling with the intention of purchasing a cheaper one can free up some money while still providing the benefits of owning a home. If you plan on downsizing and moving to a rural area, keep in mind there are trade-offs – consider your social network and access to health services before committing. Some other ideas to make some money off your home are:

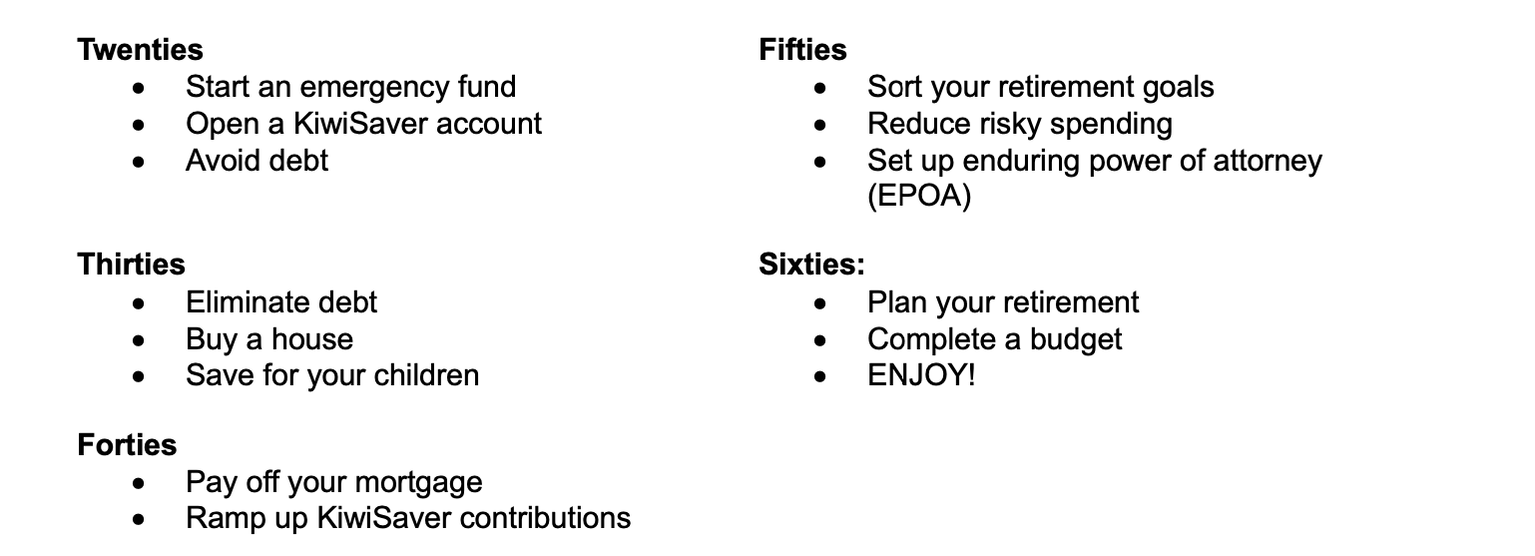

Preparation by decade How old are you now? How much time do you have left to prioritise the big save? You could make this easier for yourself by breaking it into the financial priorities for each decade of life. If you’re mid child-rearing then it’s not prime time for really pulling your socks up, but if you’re heading toward 60 then you’ll need to get amongst it.  Tools to help you prepare Sorted.org.nz website – you’ll find all sorts of tips and tools to help you handle your money well! Get a financial adviser – they can help you define your goals and objectives, take into account your personal circumstances; and develop a plan; you can start by looking for one at financialadvice.nz/find-an-adviser Chat to your KiwiSaver provider – they may offer financial advice or provide you with a financial adviser who can help you work out what is the right fund for you. Ref: Aged Advisor NZ NZ’s Best Magazine Comments are closed.

|

AuthorShonagh O'Hagan Archives

July 2024

|

RSS Feed

RSS Feed