|

Top Tips for a Tidy Transition Leaving a family home can be as much an emotional disconnection as a physical one. But at what point does the cost of emotional connection to a house outweigh an older adult’s wellbeing?  Suzi Brown explains Leaving a family home can be as much an emotional disconnection as a physical one. The family home might be where you brought your brand-new babies home to, where they were raised, where celebrations and commiserations were experienced. But at what point does the cost of emotional connection to a house outweigh an older adult’s wellbeing? It’s inevitable that at some point it will become more clear that the season for your family to enjoy the security of that home has passed. Time to pass the property baton to other whanau to flourish under its roof. The question is, HOW does one even begin the process emotionally or physically, without being buried under a mountain of unneeded but previously loved possessions? Let’s investigate. Robyn from Transition Navigators, an organisation who works with elders to find the accommodation that best fits their needs, stresses the importance of not underestimating the time it takes to talk through the options to arrive at the right choice. Ideally, it should be a conversation started in your late 50’s or early 60’s. She comments that everyone’s Plan A is always the best scenario, which is rarely the reality. Plan B involves the reality of planning and saving for a successful outcome. Think of it this way, we spend lots of time transitioning children from one important step to the other - preschool – primary school – higher options, but where is that transition planning and support at the other end? Do your sums The best strategy is to start by asking the difficult questions and doing some basic maths for comparison. While staying in your own home may mean you're saving on some things; also remember that moving into a retirement village means you can budget all the expected fees ahead of time; and you don’t need to worry about rates. For example, as part of ‘Ryman’s Peace of Mind Guarantee’ for independent living and serviced-apartment living, your basic weekly fee will never increase, unless you change your living arrangements or add extra aged-care options. Their fixed weekly fee for independent living covers maintenance, services and lifestyle (social time and happy hour, their activities programme). You can enjoy the benefits of disposing of those annoying tasks like washing windows and organising building insurance. If you need someone to change your light bulb, simply call up the maintenance man and it will be done. For some people, removing that to-do list equals independence more than remaining in their own community home. Let the professionals help If figuring this all out is just a bit too overwhelming, there are businesses who specialise in helping through this process. The beauty of using an outsider is that they aren’t emotionally involved in your life, so they have the benefit of viewing your situation from a fresh angle. They can assist with de-cluttering and navigating your move. I sat down for a quick chat with two experienced women who provide practical solutions through their businesses which specialise in this area. Transition Navigators With a warm and welcoming twinkle Robyn is experienced in helping older people and their families make informed choices. Her organisation works with older people who are planning to downsize from their family home, or with families when a health crisis signals a change in circumstance. Her role is to research the best options and work with older adults and their family to navigate a smooth transition. Robyn has a wealth of useful experience, with a PhD on the wellbeing of independently living older people – both those living in retirement villages and in the community. Neat Spaces Helen’s business, as a Professional Organiser, works alongside elders, helping bring more order and efficiency while de-cluttering and managing life transitions. Her services include setting up sustainable systems, storage solutions, creating usable spaces, paper management and deceased estate assistance. Your own private Marie Kondo with a reliable touch! What about all that dreaded ‘sorting out’? If moving house looks like the best solution. It could be time to tackle a monstrous sort out session. Downsizing from a family home full of memories is an emotional time, so how do we identify what to keep, and recognise what to donate or sell? How do we navigate the emotional upheaval of letting go of items steeped in memories? Once again, this is something that takes time. Ideally we need to start this task early, thinking about what items are really important to us and then communicating that with our children or loved ones. Maybe you need to ask what sparks joy for them and be able to give them these items in advance. Belongings that were really important to previous generations can hang a heavy mantle of responsibility on your shoulders. If you don’t want these items, and neither do your children then some difficult choices need to be made. Although you might feel a bit silly, you could try the Marie Kondo approach of holding the item, thanking it for its use and value for a moment, and then releasing it. If you’re going through this process with your elderly parent, remember to show empathy and listen to the associated stories, even if you’ve heard them plenty before! Helen from Neat Spaces likens the process to an onion – peeling one layer at a time. She notes there is a fear around the connection of letting possessions go, meaning letting memories go. Often clients think when they donate or sell an item, they’re letting go of all the special memories, but in taking time to say goodbye you can retain those memories. Find peace from moving into a new season. A new space can provide the fresh appeal of a less cluttered environment which will result in a less chaotic mind.  Anyone heard of ‘Swedish Death Cleaning’? Once again the Swedish have found a fabulous way to do something boring much better than anyone else on the planet. Heck, they probably look gloriously tanned, blonde and beautiful doing it too. The idea is this: once you reach the end of middle age (or round about that time), you quite simply just get rid of stuff that’s built up and not needed anymore so that no one else has to do it once you pop your Crocs. In Sweden, it is called döstädning – dö meaning “death” and städning meaning “cleaning.” The 2018 book by author Margareta Manusson called “The Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of Clutter” centres on this topic and is touted as “a charming, practical, and unsentimental approach to putting a home in order while reflecting on the tiny joys that make up a long life.” Apparently Manusson’s method makes the process uplifting rather than overwhelming, so it could be worth a look if you’re in the market for inspiration. Her book reminds us that once we’ve decluttered, we’ll be able to focus better on the really important things in life. Once the decluttering is complete, you’ll feel less stressed as a reflection of less mess on the outside. The reality of the whole process of Swedish Death Cleaning is that getting rid of items reminds us that things don’t last forever, including us, and wouldn’t you rather be the one to make the choices about what happens to all your stuff, than some other person who might just biff it all in the skip? Stay put Check out all your options. Could you stay put for another few years with the addition of services coming into your home? To know if you should stay or go officially, your GP team or a community health worker can refer you for a needs assessment. These exist to find out whether you need support, and to assess the most suitable support you specifically need. The support services could cover:  Personal care such as getting out of bed, showering, dressing and helping you with your medications

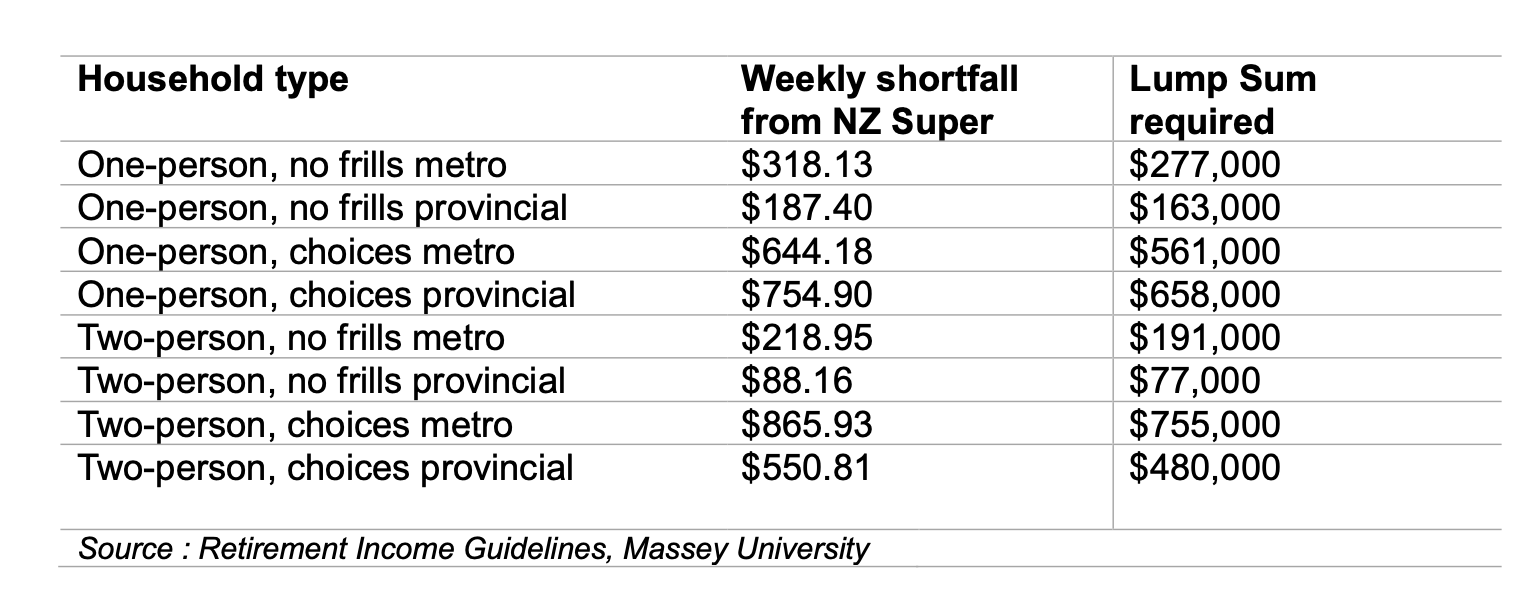

A good place to start for services are Access Community Health, Healthcare New Zealand or Nurse Maude (Christchurch only). What place do we choose? In the industry they’re known as “The Big Six” – Ryman, Metlife, Summerset, Bupa, Oceania, and Arvida. They are significant players in the New Zealand Retirement Village market, and between them they have an estimated 43% of villages throughout the country. You might have a natural inclination of which one you’d like to investigate due to location, amenities or already having friends in that particular village, but if you’re a bit unsure which direction to turn we have a handy suggestion! www.agedadvisor.nz is an independent review website specialising in aged care. The benefit of visiting Aged Advisor is that the reviews are completely unbiased by the companies themselves. Search up your top choices and read reviews from people who actually live in the villages or aged care facilities without the skew of village marketing. There are also helpful articles and due to the success of their retirement village reviews, the website will be expanding into funeral, legal and financial reviews. Don’t forget to pay it forward when you’re all settled in your lovely new abode by writing your own review on your chosen provider too. Remember to be empathetic to yourself when making your final choices, but also remember to weigh your choice up with the concern it would cause your loved ones. At the very least, maybe get a bit of Swedish Death Cleaning underway, and reduce the trip hazards in your home whilst also preparing to relocate. Give your choices time, talk the options over and you’ll be sorted, tidy and in no time. Ref: Aged Advisor NZ NZ’s Best Magazine Financial Planning for Retirement Those clever planning types (you know the ones, they’re good at spreadsheets) set the example by getting ahead of the game. But for those amongst us who are more of the creative, ‘fly by the seat of your pants type’, how do we arrange finances so we don’t arrive at 65, 75, 85 then wonder how to afford a few tea bags and a reasonable haircut? Suzi Brown explains Each decade or season of life brings an opportunity to get your financial ducks in an organised row, so you can continue enjoying the kind of lifestyle you’ve enjoyed during working years, in your retirement.  To begin the process, it would be helpful to have a dollar figure goal in mind. But considering we’re not given a definite number of years at birth, how on earth can do we work out how much we’ll need? Stats NZ Tatauranga Aotearoa’s latest report shows life expectancy at birth has continued to increase. They now project males to live to 86.1 years and females to 89 years by 2050. In researching this article, I stumbled upon a somewhat grim-reeperish, yet necessary tool which has been created called the ‘How long will I live calculator’ on the stats.govt website. Basically, you enter the year you were born, your age and sex and kazam! There’s your answer, divided helpfully into three categories assuming low, medium and high death rates. You’ll also need to decide whether you’d like to live a no frills or extravagant retirement lifestyle or sit somewhere in the middle with enough popped aside for the odd splurge if the opportunity arises. It’s really an essential first step for smart retirement planning – overestimate your longevity on the one hand and you could leave retirement too late or live too frugally, but underestimate and you could be low on funds. The table overleaf, put together by Massey University, gives you an estimate of the type of figure you may need to work toward. This amount depends on the number of people in your household, whether you’ll be aiming for a no-frills or ‘choices’ type of retirement and your location. Once you’ve figured out your sobering estimate of years left on earth and broken down how much you might need, it’s time to write some lists. Start with jotting down the things that are important for you to do now, and that you’d like to continue doing when you stop paid work. Then – this is the fun bit – add the things you have always wanted to do during retirement. Don’t be afraid to be extravagant at first! That’s what a budget is for. Write down that fancy cruise you’ve always dreamed of. It might mean you have to scrimp and save, or maybe buy second hand a bit more, but keep your end goal in mind and do what you need to do to get to those big ticket items – YOLO (you only live once)!  Where do your dollars and cents actually go? It’s smart to be organised when spending, to allow for as much saving opportunity as possible. Think about: Renewing subscriptions: sift through your credit card statements carefully and check for subscriptions you don’t need or didn’t even realise you were still paying for. Planning meals and grocery shopping – regular meals out or last-minute takeaways can really impact your pocket. Plan your weekly meals and shop accordingly to save those hangry dashes at the drive through! Prioritise paying off high-interest debt – be wary of purchases that offer monthly payments with interest. Does your spending match your goals and values? – keep your core values at the forefront. Before you pull out your EFTPOS card ask yourself if the purchase you’re about to make lines up with what’s really important to you. Why not earn a few extra bucks? Around a third of Kiwis continue some form of paid work past age 65. It’s a great way to add a few more dollars to cover your daily expenses, as well as keep some social connection and continue to feel a sense of value. Think about finding an opportunity which allows more flexible hours, part time or casual work, consultancy or mentoring, and the great thing is, income from paid work will not affect your entitlement to NZ Super. Your house is an asset It’s a really good idea to think ahead about where you're planning to live once you’ve hit the golden age of retirement. If you’ve been living in your family home for some time, selling with the intention of purchasing a cheaper one can free up some money while still providing the benefits of owning a home. If you plan on downsizing and moving to a rural area, keep in mind there are trade-offs – consider your social network and access to health services before committing. Some other ideas to make some money off your home are:

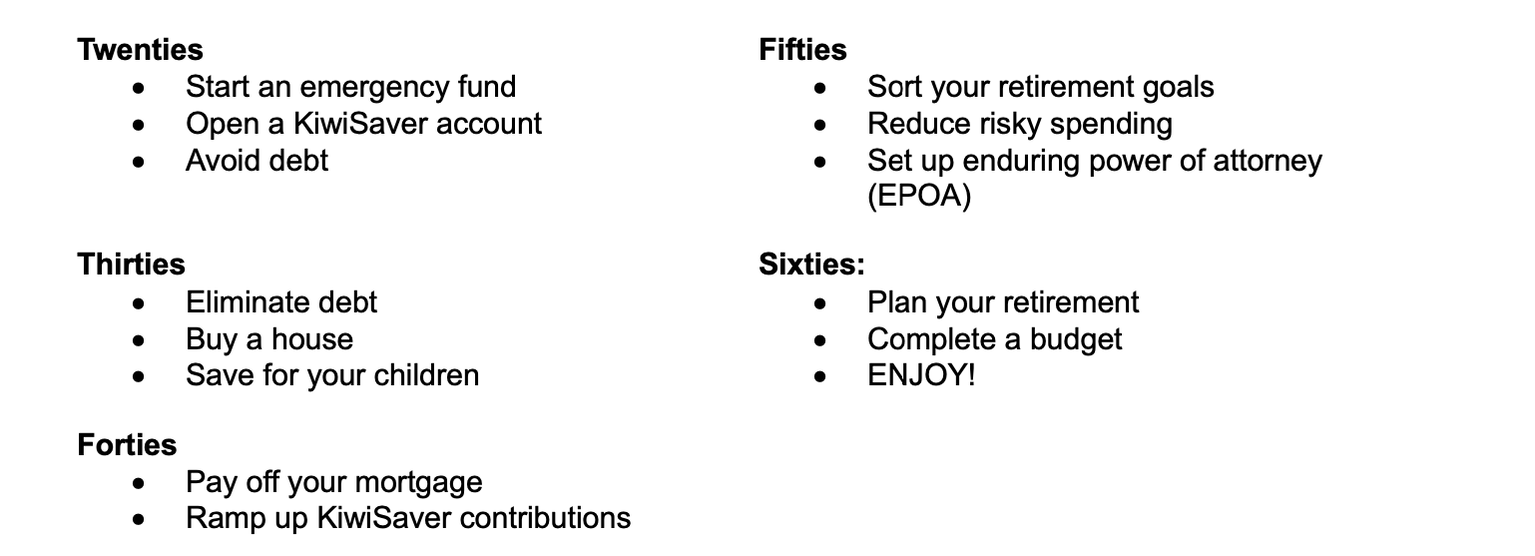

Preparation by decade How old are you now? How much time do you have left to prioritise the big save? You could make this easier for yourself by breaking it into the financial priorities for each decade of life. If you’re mid child-rearing then it’s not prime time for really pulling your socks up, but if you’re heading toward 60 then you’ll need to get amongst it.  Tools to help you prepare Sorted.org.nz website – you’ll find all sorts of tips and tools to help you handle your money well! Get a financial adviser – they can help you define your goals and objectives, take into account your personal circumstances; and develop a plan; you can start by looking for one at financialadvice.nz/find-an-adviser Chat to your KiwiSaver provider – they may offer financial advice or provide you with a financial adviser who can help you work out what is the right fund for you. Ref: Aged Advisor NZ NZ’s Best Magazine Music Therapy Week  Music Therapy New Zealand (MThNZ) is delighted to announce the upcoming Music Therapy Week, aligning with the World Federation of Music Therapy’s (WFMT) Music Therapy Week, from 10th – 15th April 2024. The 2024 theme ‘Looking Back Moving Forward’ serves as a poignant reflection on the rich history within the music therapy profession, honouring the dedicated individuals and co-collaborators working towards the growth of music therapy in New Zealand. For Music Therapy Week 2024, MThNZ is excited to offer the opportunity to interview registered Music Therapists from across Aotearoa. These passionate professionals will share their insights into why music therapy is crucial for individuals and communities. MThNZ’s purpose is to champion potential and well-being through the professional use of music therapy. As a therapeutic practice, music therapy is carefully planned to assist the health and personal growth of individuals with identified needs. Registered music therapists possess highly honed skills to work with a diverse range of conditions, including physical and intellectual disabilities, neurological conditions, mental health and mood disorders, and substance abuse issues. The adaptability and versatility of music therapy enable its application in various contexts such as schools, community spaces, hospitals, care and supported living facilities, prisons, and private practices. Sarah Cole, Executive Officer of Music Therapy NZ, emphasizes, “In Aotearoa, music therapy is increasingly being used to assist in general wellbeing, providing support for those living through the challenges of trauma, separation, grief, and end-of-life care.“ The WFMT’s initiative for a World Music Therapy Week (WMTW), celebrated annually from the 10th to the 15th of April, highlights the global connectedness of music therapy. This event encourages music therapists and supporters worldwide to engage in activities that raise awareness and advocate for the therapeutic benefits of music. Sarah Cole notes, “Music therapy transcends borders, and the global recognition through World Music Therapy Week emphasizes the collective commitment to improving lives through the power of music.“ “New Zealand contributes significantly to the worldwide trend of success for clients through music therapy. Our passionate and highly skilled therapists are dedicated to utilising music to enhance the lives of individuals facing diverse challenges. As a country, we strive to be at the forefront of promoting the global connectedness and therapeutic impact of music therapy.“ Liz Wallace Music Therapist at Therapy Professionals has recently published an article on her work with people with an Intellectual Disability which may assist your understanding of how music therapy works in practice. Read Liz's article here

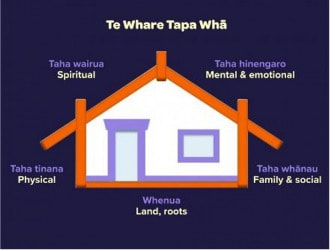

Also take a look at Radio New Zealand's recent segment on music therapy and how it is helping to build confidence in children. https://www.rnz.co.nz/national/programmes/ninetonoon/audio/2018933828/using-music-therapy-to-build-confidence-in-children Connecting with your community to enhance wellbeing Acute isolation has the same effect as hunger on the body from Aged Care New Zealand Issue 1 2022  As the pandemic has swept through countries around the world, life as we know it has been shaken up in unprecedented ways. Constraints on our daily activities to keep ourselves and each other safe has come with not only an economic but also a social cost, as people deal with lockdown fatigue, anxiety around falling sick, and more. Social isolation and loneliness have been widespread issues for a long time, but it has become much more pronounced across a range of groups since the COVID pandemic arrived over two years ago. In fact, pre-pandemic surveys show that one in five pensioners in NZ living at home felt extreme loneliness. As bleak as these statistics are, the social isolation and restrictions on movement have also presented opportunities to take a more conscious approach to how we manage our wellbeing. About social isolation and loneliness Although the terms are often used interchangeably, there are two separate definitions for social isolation and loneliness. Social isolation describes the amount or quantity of social interaction one has while loneliness describes the quality of one’s social interactions. In essence, this means that it is possible to feel lonely even with regular social interaction and on the flipside, people who do not require and don’t have high levels of social interaction don’t always experience loneliness. However, it is common for social isolation to be a precursor to loneliness. Social isolation and loneliness have been shown to be detrimental to both physical and mental health. During the pandemic, loss of face-to-face interaction, including family time, religious services and social clubs has been felt acutely, particularly by older populations. In addition to the emotional pain of loneliness, research is exploring the impact on physical health as well. Some of the adverse effects linked to loneliness include increased risk of diseases and disorders such as dementia, heart disease, stroke, cancer and functional decline. One study showed that acute isolation has the same effect as hunger on the body. Because loneliness can cause stress, elevated levels of the stress hormone cortisol has been observed in people who experience prolonged loneliness. This in turn causes inflammation in the body and leads to increased risk to physical health. These harmful effects of social isolation and loneliness are the rationale for taking action to improve our wellbeing. Fortunately, there are a few easy ways to change things up and reach a happier, more fulfilling mental state. Looking after wellbeing during a pandemic During the pandemic, many places turned to technology to connect with loved ones from afar. Religious services and healthcare have also gone digital, and many older people adapted well to these changes. Even if newer technologies such as video calling may not be everyone’s forte, phone calls are still a great alternative. Lockdowns and social distancing have compelled us to be creative about the ways we connect with each other and to take stock of the ways we keep ourselves happy and healthy. A more holistic way of taking care of our wellbeing comes from the Māori health model Te Whare Tapa Whā, devised by Sir Mason Durie. This model uses a whare (house) to describe four pillars of wellbeing: taha wairua/spiritual wellbeing, taha hinengaro/mental and emotional wellbeing, taha tinana/physical wellbeing and taha whānau/family wellbeing and social wellbeing. Our connection with the whenua/land forms the foundation. When the pillars and foundation of the house are strong, so is our wellbeing.  Some ideas for tending to each pillar:

While it may seem daunting initially to incorporate new changes into our lives, it can also be an exciting opportunity to extend ourselves and see what benefits can occur from stepping out of our comfort zone. How others are connecting since COVID Over the last two years the Mental Health Foundation and All Right? have been working on developing the Getting Through Together campaign to spread wellbeing messages during the pandemic. As part of the campaign several people shared their stories of how they were connecting with each other from afar. Sharing the love At level three of lockdown Steven would drive to the rest home, where his wife resided. He parked up below her window and displayed hand painted signs. “It wasn’t easy, but the hardest thing was rattling around at home all by myself and knowing she was less than five minutes drive down the road.” John and Jill At 83 and 81 respectively, John and Jill say the COVID 19 crisis was unlike anything they have experienced. The modern conveniences of 2020 meant that the pair managed to create online versions of their normal day to day life. Their 10 grandchildren and three step grandchildren all kept in touch via FaceTime, “at a higher rate than they might normally have heard from them,” Jill grins. Jill also has wine group that’s been meeting every second Friday for the past 30 years, and there was no way COVID 19 was slowing that down, with the group reconvening over Zoom every fortnight instead. John’s weekly walks with his group of friends, followed by a long lunch turned into frequent phone calls and email chains, and he even found a solution to missing his trips to the Christchurch art gallery – overseas galleries like The Metropolitan Museum of Art in New York offered virtual tours around their exhibitions.  More support While we always recommend that you speak to your family doctor or GP for any health-related concerns, if you’re looking for more resources, support, and further information, here are some useful places to start. To chat with a trained counsellor 24/7, free call or text 1737. The Mental Health Foundation of New Zealand works towards creating a society free from discrimination, where all people enjoy positive mental health and wellbeing. Resources and information are available from the web shop at shop.mentalhealth.org.nz or call 09 623 4812. Age Concern New Zealand is a charity providing expert information and support services in response to older people’s needs. There are many local branches throughout the country to service local communities. To get in touch, you can visit the website www.ageconcern.org.nz or freephone the national office at 0800 652 105. Yellow Brick Road (formerly Supporting Families) is a charity that provides mental health support for families who have a loved one experiencing mental health challenges. They are experienced in supporting carers. Visit their website at yellowbrickroad.org.nz. Let’s End Loneliness is a project to tackle loneliness and create communities in which New Zealanders have the relationships they need to thrive. Their website letsendloneliness.co.nz features resources and create communities in which New Zealanders have the relationships they need to thrive. Their website letsendloneliness.co.nz features resources and initiatives to foster social connection. Mental Health Foundation Ref: Aged care Issue 1 2022. |

AuthorShonagh O'Hagan Archives

April 2024

|

RSS Feed

RSS Feed